Paper:

The Influence of Factor Price Distortions on Economic Structure – Based on Time-Varying Elasticity Production Function Model

Shangfeng Zhang, Qi Fang, Huiru Ren, Chun Zhu, Jingjue Xu†, and Lang Hu

College of Statistics and Mathematics, Zhejiang Gongshang University

18 Xuezheng Street, Xiasha Education Park, Hangzhou, Zhejiang 310018, China

†Corresponding author

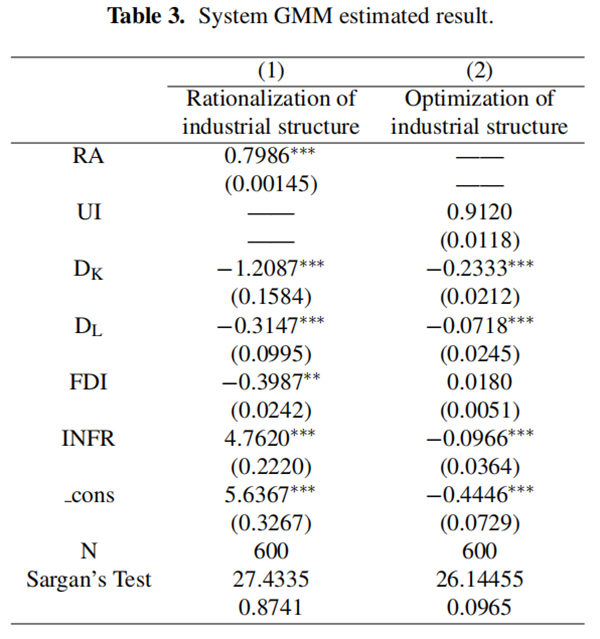

Based on the time-varying elasticity production function model, we calculate factor price distortions, and study their influence on the rationalization and optimization of industrial structure. We find that the impact coefficient of capital, and labor factor price distortions on the rationalization of industrial structure are −1.2087 and −0.3147 respectively. Additionally, the impact coefficients on the optimization of industrial structure are −0.2333 and −0.0718 respectively. These results demonstrate that capital and labor factor price distortions are significantly negative for the rationalization and optimization of industrial structure. Therefore, it is imperative to reduce factor price distortions, and support industrial structure upgrades to promote supply-side structural reform.

Effect of industrial structure upgrade

- [1] Z. Yuan and D. Xie, “The Effect of Labor Misallocation on TFP: China’s Evidence 1978–2007,” Economic Research J., Vol.2011, No.7, pp. 4-17, 2011 (in Chinese).

- [2] G. Yang, P. Sun, and G. Gong, “Growth Volatility, Adjustment Cost and Resource Allocation,” Economic Research J., Vol.2015, No.2, pp. 47-60, 2015 (in Chinese).

- [3] Y.-W. Chen, “Resource Misallocation: Problems, Causes and Countermeasures,” Ph.D. Thesis, Peking University, 2013 (in Chinese).

- [4] L. Wang and L. Yuan, “Was Capital Misallocation an Important Factor for Loss in Total Factor Productivity?,” Statistical Research, Vol.31, No.8, pp. 11-18, 2014 (in Chinese).

- [5] S. P. Magee, “Factor Market Distortions, Production and Trade: A Survey,” Oxford Economic Papers, Vol.25, No.1, pp. 1-43, 1973.

- [6] Y.-J. Shi, “The influence of factor market distortion on industrial structure upgrading,” Modern Business, Vol.2010, No.23, pp. 186+188, 2010 (in Chinese).

- [7] P. Han and C.-Q. Wu, “The Causes of Factor Price Distortions and the Impact to the Economic Structure,” J. of Harbin University of Commerce (Social Science Edition), Vol.2012, No.5, pp. 3-9, 2012 (in Chinese).

- [8] X.-H. Xia and J.-Y. Li, “Distortion of factor price heterogeneity and dynamic adjustment of industrial structure,” J. of Nanjing University (Philosophy, Humanities and Social Sciences), Vol.49, No.3, pp. 40-48, 2012 (in Chinese).

- [9] X.-Y. Shang, “The Impacts of Factor Markets Price Distortions on China’s Economy: Theory and Empirical Analysis,” Ph.D. Thesis, Wuhan University, 2016 (in Chinese).

- [10] G. Li, M. Lu, Z. Zhao, and Z. Shi, “Research on The Impact of Factor Price Reform on Industrial Transformation and Upgrading,” Price: Theory & Practice, Vol.2016, No.9, pp. 93-96, 2016 (in Chinese).

- [11] P. Chen, “Factor Price Distortions, Optimization of Industrial Structure and Market Access for Relaxing,” On Economic Problems, Vol.2016, No.8, pp. 42-45+55, 2016 (in Chinese).

- [12] S. F. Zhang and B. Xu, “Analysis of china’s unbalanced economic growth,” The J. of Quantitative & Technical Economics, Vol.32, No.3, pp. 94-110, 2015 (in Chinese).

- [13] C. Li, “Factor Market Distortion, Capital Deepening and Industrial Structure Adjustment: The Empirical Analysis Based on Production Functions with Time-Varying Elasticity,” Statistics & Information Forum, Vol.30, No.2, pp. 60-66, 2015 (in Chinese).

- [14] S.-F. Zhang, “Estimation and Decomposition of the Theory Labor Share:——Based on the Time-varying Elasticity Production Function Model,” J. of Business Economics, Vol.2016, No.12, pp. 83-90, 2016 (in Chinese).

- [15] K. Akamatsu, “Trends in our trade in industrial wool,” Shogyo Keizai Ronso, Vol.13, Part 1, pp. 129-212, 1935 (in Japanese).

- [16] R. W. Jones, “Distortions in Factor Markets and the General Equilibrium Model of Production,” J. of Political Economy, Vol.79, No.3, pp. 437-459, 1971.

- [17] B.-F. Wang, “Research on the Impact of Factor Distortion on the Economic External Imbalance of China,” Ph.D. Thesis, Liaoning University, 2016 (in Chinese).

- [18] S. Zhang and B. Xu, “Production Functions with Time-Varying Elasticities and under the Catch-up Consensus: Total Factor Productivity,” China Economic Quarterly, Vol.8, No.2, pp. 551-568, 2009 (in Chinese).

- [19] C. Gan, R. Zheng, and D. Yu, “An Empirical Study on the Effects of Industrial Structure on Economic Growth and Fluctuations in China,” Economic Research J., Vol.2011, No.5, pp. 4-16+31, 2011 (in Chinese).

- [20] B.-B. Yu, “Economic Growth Effects of Industrial Restructuring and Productivity Improvement – Analysis of Dynamic Spatial Panel Model with Chinese City Data,” China Industrial Economics, Vol.2015, No.12, pp. 83-98, 2015 (in Chinese).

- [21] H.-J. Shan, “Reestimating the Capital Stock of China: 1952∼2006,” The J. of Quantitative & Technical Economics, Vol.25, No.10, pp. 17-31, 2008 (in Chinese).

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.