Paper:

Time-Varying Transmission Effects of Internet Finance Under Economic Policy Uncertainty and Internet Consumers’ Behaviors: Evidence from China

Guangtong Gu*1,*2,*3,*4 and Wenjie Zhu*1,†

*1Faculty of Economics and Management, Zhejiang A & F University

Yijin Street, Lin’an, Hangzhou, Zhejiang 311300, China

*2Zhejiang Province Key Cultivating Think Tank–Research Academy for Rural Revitalization of Zhejiang Province, Zhejiang A & F University

Yijin Street, Lin’an, Hangzhou, Zhejiang 311300, China

*3Institute of Ecological Civilization, Zhejiang A & F University

Yijin Street, Lin’an, Hangzhou, Zhejiang 311300, China

*4Institute of Carbon Neutrality, Zhejiang A & F University

Yijin Street, Lin’an, Hangzhou, Zhejiang 311300, China

†Corresponding author

The modern finance industry is composed of not only numerous financial intermediaries but also internet-based mechanisms which are operated by mobile phone users and online consumers daily. In the coming 10 years, estimates suggest that over half of banks’ functions will likely be replaced by high-tech artificial intelligence. Given the great ongoing shifts in contemporary financial systems, the transmission effects of internet-based finance practices have introduced an important yet unaddressed empirical question on the coupling relationship between the internet finance industry and economic policy uncertainty (EPU). This paper adopts the time-varying parameter vector autoregressive model with stochastic volatility (TVP-SV-VAR) model and novel data from Alibaba Corp. to investigate this relationship. We find: First, the impact of internet-based financial approaches on EPU is greater than the reversal effect, indicating that China’s gross domestic product (GDP) is largely influenced by the online finance industry. Second, the lag impacts are time varying and become stable after 2016, corresponding to the current Chinese government’s long-term strategic plan that emphasizes maintaining the economy’s overall stability. Lastly, additional evidence shows that the online financial approaches are positively correlated with consumers’ behaviors, implying that the online finance industry is gaining its momentum when people are using e-currency rather than real cash. After all, it takes time to observe the real effect of these macro policies. With internet and information technology developing, artificial intelligence is being used in the areas of big data, credit lending, and risk control. This largely reduces the data analyzing cost for internet finance companies and makes risk control more convenient.

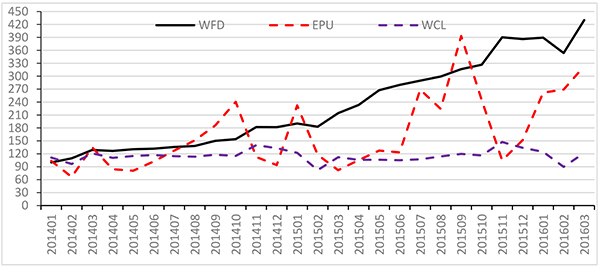

Internet finance trend, internet consumption trend, and EPU trend

- [1] K. C. Laudon and C. G. Traver, “E-commerce: Business, Technology, Society,” http://dspace.fue.edu.eg/handle/123456789/4464 [accessed January 1, 2016]

- [2] P. Gomber, J.-A. Koch, and M. Siering, “Digital finance and FinTech: Current research and future research directions,” J. of Business Economics, Vol.87, No.5, pp. 537-580, 2017.

- [3] X. Zhu, “Case V: Alibaba: A decade-long road to financial services,” X. Zhu, “China’s technology innovators: Selected cases on creating and staying ahead of business trends,” pp. 83-109, Springer, 2018.

- [4] X. Kuang, F. Zhao, H. Hao, and Z. Liu, “Intelligent connected vehicles: The industrial practices and impacts on automotive value-chains in China,” Asia Pacific Business Review, Vol.24, No.1, pp. 1-21, 2018.

- [5] J. Li, Y. Zhang, D. Wu, and W. Zhang, “Impacts of big data in the Chinese financial industry,” The Bridge, Vol.44, No.4, pp. 20-26, 2014.

- [6] Team of National Internet Finance Industry Project, “The development, risk, and supervision – a forum discussion,” Economic Research, Vol.50, No.11, pp. 183-186, 2015 (in Chinese).

- [7] C. J. Adcock, C. Ye, S. Yin, and D. Zhang, “Price discovery and volatility spillover with price limits in Chinese A-shares market: A truncated GARCH approach,” J. of the Operational Research Society, Vol.70, No.10, pp. 1709-1719, 2019.

- [8] D. Helbing, “Societal, economic, ethical and legal challenges of the digital revolution: From big data to deep learning, artificial intelligence, and manipulative technologies,” D. Helbing (Ed.), “Towards digital enlightenment: Essays on the dark and light sides of the digital revolution,” pp. 47-72, Springer, 2019.

- [9] D. Croasdell and A. Palustre, “Transnational cooperation in cybersecurity,” Proc. of the 52nd Hawaii Int. Conf. on System Sciences (HICSS-52), 2019.

- [10] E. Iasiello, “China’s cyber initiatives counter international pressure,” J. of Strategic Security, Vol.10, No.1, pp. 1-16, 2017.

- [11] B. Xu and Y.-C. Chang, “The new development of the ocean governance mechanism in Taiwan and its reference for China,” Ocean & Coastal Management, Vol.136, pp. 56-72, 2017.

- [12] H. Zhao, “The economics and politics of China’s energy security transition,” Elsevier Inc., 2019.

- [13] N. Kshetri, “Big data’s role in expanding access to financial services in China,” Int. J. of Information Management, Vol.36, No.3, pp. 297-308, 2016.

- [14] F. Allen, J. McAndrews, and P. Strahan, “E-finance: An introduction,” J. of Financial Services Research, Vol.22, No.1, pp. 5-27, 2002.

- [15] P. Xie and C. Zou, “A study on internet based finance model,” J. of Financial Research, Vol.2012, No.12, pp. 11-22, 2012 (in Chinese).

- [16] I. Lee and Y. J. Shin, “Fintech: Ecosystem, business models, investment decisions, and challenges,” Business Horizons, Vol.61, No.1, pp. 35-46, 2018.

- [17] P. Xie, C. Zou, and H. Liu, “The fundamental theory of internet finance,” J. of Financial Research, Vol.2015, No.8, pp. 1-12, 2015 (in Chinese).

- [18] A. Mas-Colell, M. D. Whinston, and J. R. Green, “Microeconomic Theory,” Oxford University Press, 1995.

- [19] K. Matthews and J. Thompson, “The economics of banking,” 3rd Edition, John Wiley & Sons, Inc., 2019.

- [20] X. Liu, J. Chen, and Y. Wang, “The construction of internet finance eco-system – from the perspective of business,” Modern Economic Research, Vol.2017, No.4, pp. 53-57, 2017 (in Chinese).

- [21] P. Xie, C. Zou, and H. Liu, “The fundamentals of internet finance and its policy implications in China,” China Economic J., Vol.9, No.3, pp. 240-252, 2016.

- [22] B. Özoğlu and A. Topal, “Digital marketing strategies and business trends in emerging industries,” U. Hacioglu (Ed.), “Digital business strategies in blockchain ecosystems: Transformational design and future of global business,” pp. 375-400, Springer, 2020.

- [23] K. Li, “The innovation and risk for internet finance industry,” Management World, Vol.2016, No.2, pp. 1-2, 2016 (in Chinese).

- [24] P. Xie and C. Zou, “A study on internet based financial model,” J. of Financial Research, Vol.2012, No.12, pp. 11-22, 2012 (in Chinese).

- [25] P. Schueffel, “Taming the beast: A scientific definition of fintech,” J. of Innovation Management, Vol.4, No.4, pp. 32-54, 2016.

- [26] Y. Yao and D. Shi, “Exploring regional differences in development of internet finance: Perspectives of path dependence and government interference,” J. of Financial Research, Vol.2017, No.5, pp. 127-142, 2017 (in Chinese).

- [27] D. Wang, “Development of internet finance in the U.S. and Sino-U.S. comparison: Research and thoughts from the perspective of network economics,” Studies of Int. Finance, Vol.2014, No.12, pp. 47-57, 2014 (in Chinese).

- [28] M. Baddeley, “Investment, unemployment and the cyber revolution,” P. Arestis and M. Sawyer (Eds.), “Economic policies since the global financial crisis,” pp. 173-220, Palgrave Macmillan, 2017.

- [29] M. Rojszczak, “Does global scope guarantee effectiveness? Searching for a new legal standard for privacy protection in cyberspace,” Information & Communications Technology Law, Vol.29, No.1, pp. 22-44, 2020.

- [30] H. Sara, “Feasibility of China’s financial reforms,” The Chinese Economy, Vol.52, No.2, pp. 192-202, 2019.

- [31] F. Modigliani and R. H. Brumberg, “Utility analysis and the consumption function: An interpretation of cross-section data,” K. K. Kurihara (Ed.), “Post-Keynesian economics,” pp. 388-436, Rutgers University Press, 1954.

- [32] Q. He and M. Peng, “Research on the characteristics of P2P lending interest rate based on internet finance,” J. of Financial Research, Vol.2016, No.10, pp. 95-110, 2016 (in Chinese).

- [33] A. S. Funk, “From informal finance to internet finance in China,” A. S. Funk, “Crowdfunding in China: A new institutional economics approach,” pp. 95-147, Springer, 2019.

- [34] X. Zhu, “Introduction: From the industrial economy to the digital economy: A giant leap–research on the ‘1+10’ framework of the digital economy,” X. Zhu, “Emerging champions in the digital economy: New theories and cases on evolving technologies and business models,” pp. 1-65, Springer, 2019.

- [35] G. E. Primiceri, “Time varying structural vector autoregressions and monetary policy,” The Review of Economic Studies, Vol.72, No.3, pp. 821-852, 2005.

- [36] J. Nakajima, “Time-varying parameter VAR model with stochastic volatility: An overview of methodology and empirical applications,” Institute for Monetary and Economic Studies (IMES) Discussion Paper No.2011-E-9, Bank of Japan, 2011.

- [37] M. D. Negro and G. E. Primiceri, “Time-varying structural vector autoregressions and monetary policy: A corrigendum,” The Review of Economic Studies, Vol.82, No.4, pp. 1342-1345, 2015.

- [38] S. R. Baker, N. Bloom, and S. J. Davis, “Measuring economic policy uncertainty,” The Quarterly J. of Economics, Vol.131, No.4, pp. 1593-1636, 2016.

- [39] J. Geweke, “Evaluating the accuracy of sampling-based approaches to the calculation of posterior moments,” Research Department Staff Report 148, Federal Reserve Bank of Minneapolis, 1991.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.