Paper:

Mixed Duopoly Stochastic Sales Model with Advertising and Experience Gains for the Public and Foreign Competitors

Vitaliy Kalashnikov*,†, Natalyia Kalashnykova**, and Petr Kuzmin***

*Facultad de Economía (FAECO), Universidad Autónoma de Nuevo León (UANL)

Monterrey, Nuevo León, Mexico

**Facultad de Ciencias Físico Matemáticas (FCFM), Universidad Autónoma de Nuevo León (UANL)

Monterrey, Nuevo León, Mexico

***Department of International Institute of Economics, Management and Information Systems, Altai State University

68 Socialist Street, Barnaul 656049, Russia

†Corresponding author

In this research, we propose a stochastic model with the finite horizon of time for sales competition between the state-owned company and private (foreign) competitor. We assume that the foreign company objective function is to maximize revenues and the state-owned agent is concerned about welfare maximization. There are many stochastic models for sales, but what is new in our case is that we assume mixed oligopoly and have different types of firms: private and state owned. They have somewhat different objective functions. As a control variable, we take the advertisement expenses of the private firm. Sale bursts rate depends and the advertisement expenditure and experience stock gained. For the public firm, we assume that advertising efforts are fixed. It means that the optimal control is to maximize private firm revenues taking into account possible uncertainties of stochastic profit flow using Bellman’s optimality condition. We can find out that the Advertisement-Experience (AE) efforts of the private firm are increasing if sales are increasing. Next, the AE might decrease if the experience level of the private firm increases and we have a sales burst. To optimize the governmental policies, we check for optimal AE effort of the public firm so the social welfare achieves the maximum value.

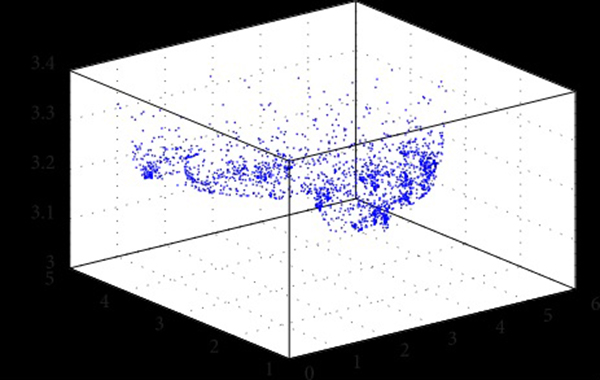

Graphical experience spillover representation

- [1] G. Barles, “Convergence of numerical schemes for degenerate parabolic equations arising in finance,” L. C. G. Rogers and D. Talay (Eds.), “Numerical Methods in Finance,” pp. 1-21, Cambridge University Press, 1997.

- [2] N. Singh and X. Vives, “Price and quantity competition in a differentiated duopoly,” RAND J. of Economics, Vol.15, No.4, pp. 546-554, 1984.

- [3] S. Sklivas, “The strategic choice of managerial incentives,” RAND J. of Economics, Vol.18, No.3, pp. 452-458, 1987.

- [4] G. de Fraja and F. Delbono, “Game theoretic models of mixed oligopoly,” J. of Economic Surveys, Vol.4, No.1, pp. 1-17, 1990.

- [5] F. Delbono and V. Denicoló, “Regulating innovative activity: The role of a public firm,” Int. J. of Industrial Organization, Vol.11, No.1, pp. 35-48, 1993.

- [6] T. Matsumura, “Partial privatization in mixed duopoly,” J. of Public Economics, Vol.70, No.3, pp. 473-483, 1998.

- [7] V. Zikos, “Equilibrium and optimal R&D roles in a mixed market,” Discussion Paper Series 2007_08, Department of Economics, Loughborough University, 2007.

- [8] R. Amir, “Modelling imperfectly appropriable R&D via spillovers,” Int. J. of Industrial Organization, Vol.18, No.7, pp. 1013-1032, 2000.

- [9] C. D’Aspremont and A. Jacquemin, “Cooperative and noncooperative R&D in duopoly with spillovers,” American Economic Review, Vol.78, No.5, pp. 1133-1137, 1988.

- [10] N. Hausenschild, “On the role of input and output spillovers when R&D projects are risky,” Int. J. of Industrial Organization, Vol.21, No.8, pp. 1065-1089, 2003.

- [11] M. I. Kamien, E. Muller, and I. Zang, “Research joint ventures and R&D cartels,” American Economic Review, Vol.82, No.5, pp. 1293-1306, 1992.

- [12] J. Poyago-Theotoky, “R&D competition in a mixed duopoly under uncertainty and easy imitation,” J. of Comparative Economics, Vol.26, No.3, pp. 415-428, 1998.

- [13] A. Naseem and J. F. Oehmke, “Spillovers, joint ventures and social welfare in a mixed duopoly R&D Race,” American Agricultural Economics Association 2006 Annual Meeting, 2006.

- [14] M. J. Gil-Moltó, J. Poyago-Theotoky, and V. Zikos, “R&D subsidies, spillovers, and privatization in mixed markets,” Southern Economic J., Vol.78, No.1, pp. 233-255, 2011.

- [15] C. M. Leung and Y. K. Kwok, “Numerical algorithms for R&D stochastic control models,” J. of Computational Finance, Vol.18, No.1, pp. 3-29, 2014.

- [16] G. Pawlina and P. M. Kort, “Real options in an asymmetric duopoly: Who benefits from your competitive disadvantage?,” J. of Economics & Management Strategy, Vol.15, No.1, pp. 1-35, 2006.

- [17] P. Aghion, P. Bolton, and S. Fries, “Optimal design of bank bailouts: the case of transition economies,” J. of Institutional and Theoretical Economics, Vol.155, No.1, pp. 51-70, 1999.

- [18] F. Allen and D. Gale, “Competition and financial stability,” J. of Money, Credit, and Banking, Vol.36, No.3, pp. 453-480, 2004.

- [19] D. Bös and W. Peters, “Privatization, internal control, and internal regulation,” J. of Public Economics, Vol.36, No.2, pp. 231-258, 1988.

- [20] U. Doraszelski, “An R&D race with knowledge accumulation,” RAND J. of Economics, Vol.34, No.1, pp. 20-42, 2003.

- [21] R. G. Hubbard and D. Palia, “Executive pay and performance evidence from the U.S. banking industry,” J. of Financial Economics, Vol.39, No.1, pp. 105-130, 1995.

- [22] J.-J. Wang et al., “Stochastic control model for R&D race in a mixed duopoly with spillovers and knowledge stocks,” Decisions in Economics and Finance, Vol.38, No.2, pp. 177-195, 2015.

- [23] I. Ishibashi and T. Matsumura, “R&D competition between public and private sectors,” European Economic Review, Vol.50, No.6, pp. 1347-1366, 2006.

- [24] T. Kato and C. Long, “Executive compensation, firm performance, and corporate governance in China: evidence from firms listed in the Shanghai and Shenzhen stock exchanges,” Economic Development and Cultural Change, Vol.54, No.4, pp. 945-983, 2006.

- [25] M. Klein, “A theory of the banking firm,” J. of Money, Credit, and Banking, Vol.3, No.2, Part 1, pp. 205-218, 1971.

- [26] A. Kumar and B. Saha, “Spatial competition in a mixed duopoly with one partially nationalized firm,” J. of Comparative Economics, Vol.36, No.2, pp. 326-341, 2008.

- [27] S. Martin, “Spillovers, appropriability, and R&D,” J. of Economics, Vol.75, No.1, pp. 1-32, 2002.

- [28] A. Steinmetz, “Competition, innovation, and the effect of knowledge accumulation,” Würzburg Economic Papers, No.81, 2010.

- [29] J. Vickers, “Delegation and the theory of the firm,” Economic J., Vol.95, Supplement, pp. 138-147, 1985.

- [30] P. A. Forsyth and G. Labahn, “Numerical methods for controlled Hamilton-Jacobi-Bellman PDEs in finance,” J. of Computational Finance, Vol.11, No.2, pp. 1-43, 2007.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.