Paper:

Asymmetric Multifractal Analysis of Rebar Futures and Spot Market in China

Qiaoyan Zhang, Lixian Wang, Shang Jin, Xiaozhen Hao, and Zhenlong Chen†

School of Statistics and Mathematics, Zhejiang Gongshang University

No.18 Xuezheng Street, Xiasha University Town, Hangzhou, Zhejiang 310018, China

†Corresponding author

In this study, a wavelet denoising method is first used to eliminate the influence of noise. Then, an overlapping smooth window technique is introduced into the asymmetric multifractal detrended cross-correlation analysis method, which was combined with the multiscale multifractal analysis method, resulting in the proposed asymmetric multiscale multifractal detrended cross-correlation analysis method. This method not only remedies the pseudo-fluctuation defect of the traditional method, but also explores the asymmetric multifractal cross-correlation between China’s rebar futures and spot markets at different scales. The results show the existence of an asymmetric multifractal cross-correlation between rebar futures and spot markets with upward and downward trends at different scales. This cross-correlation is highly complex at the small-scale, and more pronounced when the futures market is in an uptrend.

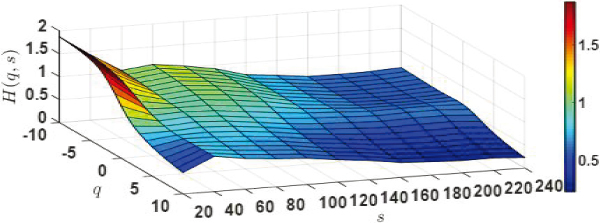

Local Hurst surface

- [1] Y. Yao, “Empirical research of price discovery in China,” Master thesis, Southwest University, 2012.

- [2] B. F. Shi, A. W. Li, and J. Wang, “Price discovery on Chinese rebar futures market,” Operations Research and Management Science, Vol.27, No.6, pp. 162-171, 2018.

- [3] G. X. Cao, Y. Han, W. J. Cui, and Y. Guo, “Multifractal detrended cross-correlations between the CSI 300 index futures and the spot markets based on high-frequency data,” Physica A: Statistical Mechanics and its Applications, Vol.414, pp. 308-320, 2014.

- [4] G. X. Cao and W. Xu, “Multifractal features of EUA and CER futures markets by using multifractal detrended fluctuation analysis based on empirical model decomposition,” Chaos Solitons & Fractals, Vol.83, pp. 212-222, 2016.

- [5] Y. Lin, D. Y. Zhang, X. Wu, and R. Z. Yan, “A research of asymmetric multifractal correlation in energy futures markets,” Management Review, Vol.29, No.2, pp. 35-46, 2017.

- [6] J. Gierałtowski, J. J. Żebrowski, and R. Baranowski, “Multiscale multifractal analysis of heart rate variability recordings with a large number of occurrences of arrhythmia,” Physical Review E, Vol.58, No.2, 021915, 2012.

- [7] W. Shi, P. Shang, J. Wang, and A. Lin, “Multiscale multifractal detrended cross-correlation analysis of financial time series,” Physica A: Statistical Mechanics and its Applications, Vol.403, pp. 35-44, 2014.

- [8] Q. J. Fan, “Asymmetric multiscale detrended fluctuation analysis of California electricity spot price,” Physica A: Statistical Mechanics and its Applications, Vol.442, pp. 252-260, 2016.

- [9] X. N. Zhang, M. Zeng, and Q. H. Meng, “Asymmetric multiscale multifractal analysis of wind speed signals,” Int. J. of Modern Physics C, Vol.28, No.11, 1750137, 2017.

- [10] Y. J. Yang, J. P. Li, and Y. M. Yang, “The cross-correlation analysis of multi property of stock markets based on MM-DFA,” Physica A: Statistical Mechanics and its Applications, Vol.481, pp. 23-33, 2017.

- [11] F. Wang, Q. J. Fan, and K. H. Wang, “Asymmetric multiscale multifractal detrended cross-correlation analysis for the 1999–2000 California electricity market,” Nonlinear Dynamics, Vol.91, No.3, pp. 1527-1540, 2018.

- [12] G. X. Cao, J. Cao, and L. B. Xu, “Detrended cross-correlation analysis approach for assessing asymmetric multifractal detrended cross-correlations and their application to the Chinese financial market,” Physica A: Statistical Mechanics and its Applications, Vol.393, pp. 460-469, 2014.

- [13] H. Zheng and B. H. Wang, “MultiFractal Empirical Study of Sino-Japanese Gold Futures Market: Based on OSW-MF-DFA Method. China,” Forward Position or Economics, No.11, pp. 35-43, 2009.

- [14] P. F. Zhu and Y. Tang, “The Current Arbitrage Strategy From The Perspective of Fractals: Empirical Evidence Based on The Data of Stock Disaster,” Statistics and Decision, No.3, pp. 167-169, 2019.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.