Research Paper:

Nonlinear Risk Spillover Path Between China’s Carbon Market, China’s New Energy Market, and the International Crude Oil Futures Market

Yanyun Yao*, Zifeng Tang**, Guiqian Niu*,†, and Shangzhen Cai***

*College of Finance & Information, Ningbo University of Finance & Economics

899 Xueyuan Road, Haishu District, Ningbo, Zhejiang 315175, China

†Corresponding author

**Department of Mathematics, Shaoxing University

900 Chengnan Avenue, Yuecheng District, Shaoxing, Zhejiang 312000, China

***College of Digital Technology and Engineering, Ningbo University of Finance & Economics

899 Xueyuan Road, Haishu District, Ningbo, Zhejiang 315175, China

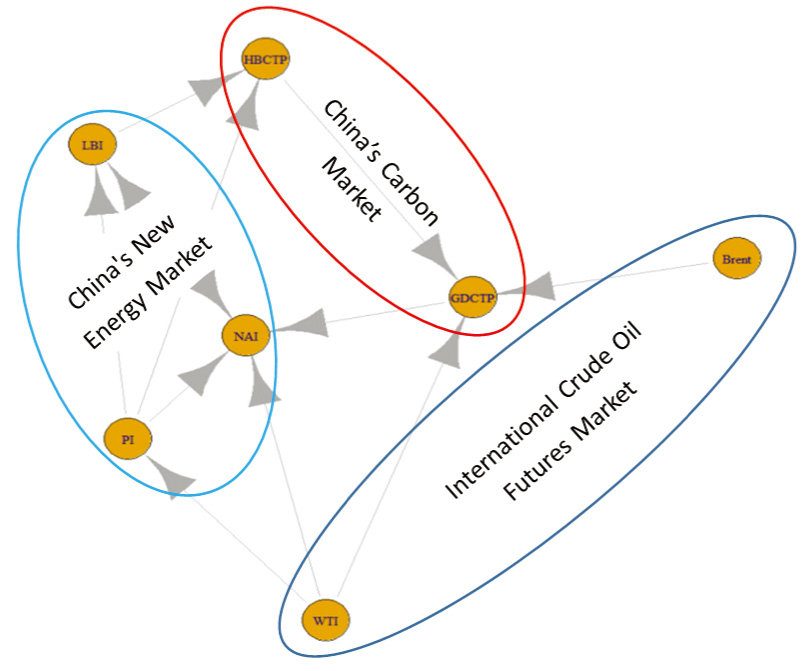

The carbon market was established to reduce carbon dioxide emissions. The traditional fossil energy market, new energy market, and carbon market have interrelated effects such as substitution, demand, and production inhibition, which can potentially lead to risk transmission. This study examines the nonlinear volatility correlation between China’s carbon market, China’s new energy market, and the international crude oil futures market. Seven submarkets within these three markets are selected for analysis. By measuring volatility risk through the conditional heteroscedasticity of returns, the analysis of nonlinear Granger causality networks reveals that, from a nonlinear perspective, risk primarily spills over through the paths of “International crude oil futures market → China’s carbon market” and “International crude oil futures market → China’s new energy market → China’s carbon market.” China’s carbon market serves as a recipient of risk, with minimal spillover effects. Therefore, further optimization is needed for the framework of China’s carbon market to enhance its asset allocation function and promote its spillover influence. Investors in China’s carbon market should consider both linear and nonlinear risks from China’s new energy market and the international crude oil futures market, and take appropriate measures to facilitate the sustainable growth of Chinese enterprises.

Associative network of the markets

- [1] Z. Lu and Y. Xiao, “Causal Relationship between Chinese Stock Market Indices and Trading Volume: Based on Linear and Nonlinear Granger Causality Tests,” Finance and Economics, Issue 09, pp. 30-37, 2017 (in Chinese).

- [2] J. Fleming, C. Kirby, and B. Ostdiek, “Information and Volatility Linkages in the Stock, Bond, and Money Markets,” J. of Financial Economics, Vol.19, Issue 1, pp. 111-137, 1998. https://doi.org/10.1016/S0304-405X(98)00019-1

- [3] M. King and S. Wadhwani, “Transmission of Volatility Between Stock Markets,” Review of Financial Studies, Vol.3, No.1, pp. 5-33, 1990.

- [4] Q. Gao and F. Li, “Dynamic Correlation between Carbon Trading Market and Fossil Energy Market in China: A Test Based on DCC-(BV) GARCH Model,” Environment and Sustainable Development, Vol.41, Issue 5, pp. 25-29, 2016.

- [5] J. Xin and C. Zhao, “Volatility analysis of carbon emission trading market in China based on MS-VAR model,” Soft Science, Vol.32, Issue 11, pp. 134-137, 2018.

- [6] A. K. Dhamija, S. S. Yadav, and P. K. Jain, “Volatility Spillover of Energy Markets Into EUA Markets Under EU ETS: A Multi-phase Study,” Environmental Economics and Policy Studies, Vol.20, Issue 3, pp. 561-591, 2018. https://doi.org/10.1007/s10018-017-0206-5

- [7] S. J. Byun and H. Cho, “Forecasting Carbon Futures Volatility Using GARCH Models with Energy Volatilities,” Energy Economics, Vol.40, pp. 207-221, 2013. https://doi.org/10.1016/j.eneco.2013.06.017

- [8] J. C. Reboredo, “Modeling EU Allowance and Oil Market Interdependence. Implications for Portfolio Management,” Energy Economics, Vol.36, pp. 471-480, 2013. https://doi.org/10.1016/j.eneco.2012.10.004

- [9] L. Yu, J. Li, and L. Tang, “Dynamic Volatility Spillover Effect Analysis between Carbon Market and Crude Oil Market: A DCC-ICSS Approach,” Int. J. of Global Energy, Vol.38, Issues 4-6, pp. 242-256, 2015.

- [10] J. C. Reboredo, “Volatility Spillovers between the Oil Market and the European Union Carbon Emission Market,” Economic Modelling, Vol.36, pp. 229-234, 2014. https://doi.org/10.1016/j.econmod.2013.09.039

- [11] X. Zhuang, Y. Wei, and B. Zhang, “Multifractal Detrended Cross-Correlation Analysis of Carbon and Crude Oil Markets,” Physica A, Vol.399, pp. 113-125, 2014. https://doi.org/10.1016/j.physa.2013.12.048

- [12] Q. Ji, T. Xia, F. Liu, and J.-H. Xu, “The Information Spillover between Carbon and Power Sector Returns: Evidence from the Major European Electricity Companies,” J. of Cleaner Production, Vol.208, pp. 1178-1187, 2019. https://doi.org/10.1016/j.jclepro.2018.10.167

- [13] Q. Ji and D. Y. Zhang, “China’s Crude Oil Futures: Introduction and Some Stylized Facts,” Finance Research Letters, Vol.28, pp. 376-380, 2019. https://doi.org/10.1016/j.frl.2018.06.005

- [14] Z. Wang and Y. Hu, “Analysis of Influencing Factors of Carbon Emission Trading Price in China,” Industrial Technical Economics, Vol.37, Issue 2, pp. 128-136, 2018 (in Chinese).

- [15] M. Lu and Y. Cang, “Grey Correlation Analysis of Energy Price Factors Affecting Carbon Price in China,” China Environmental Management, Vol.10, Issue 4, pp. 88-92, 2018 (in Chinese).

- [16] D. Wang and D. Yang, “Drivers of Carbon Trading Prices in China,” J. of Capital University of Economics and Business, Vol.20, Issue 5, pp. 87-95, 2018 (in Chinese).

- [17] J. Cui, J. Huang, and K. Li, “A Study on the Relationship among Spot Price, Energy Price and Midway Index of Carbon Emission Right Based on VAR,” Economic Issues, Issue 7, pp. 27-33, 2018 (in Chinese).

- [18] K. Chang, F. Ge, C. Zhang, and W. Wang, “The Dynamic Linkage Effect between Energy and Emissions Allowances Price for Regional Emissions Trading Scheme Pilots in China,” Renewable and Sustainable Energy Reviews, Issue 98, pp. 415-425, 2018. https://doi.org/10.1016/j.rser.2018.09.023

- [19] N. Song, Z. Li, and S. Zeng, “Volatility Information Transmission between Carbon Market and Large Asset Classes,” Resource Science, Vol.37, Issue 6, pp. 1258-1265, 2015 (in Chinese).

- [20] X. Wang, Q. Qiao, and X. Chen, “Dynamic Dependence between Carbon Emission Trading Market and New Energy Market: A Case Study of Carbon Market Pilot in China,” J. of China University of Mining and Technology (Social Sciences Edition), Vol.23, Issue 06, pp. 89-106, 2021 (in Chinese).

- [21] J. Liu, X. Ding, and H. Bu, “New Progress in Carbon Market Spillover Effect Research–Based on Literature Metrology and Social Network Analysis,” J. of Shandong Institute of Industry and Commerce, Vol.36, Issue 06, pp. 44-56, 2022 (in Chinese).

- [22] Q. Wang and C. Gao, “Spillover Effects among Pilot Carbon Markets in China: Based on VAR-GARCH-BEKK Model and Social Network Analysis,” J. of Wuhan University (Philosophy and Social Sciences Edition), Vol.69, Issue 6, pp. 57-67, 2016 (in Chinese).

- [23] W. Chen, X. Shi, and Q. Chen, “Characterizing the Dynamic Evolutionary Behavior of Multivariate Price Movement Fluctuation in the Carbon-fuel Energy Markets System From Complex Network Perspective,” Energy, Vol.239, Part A, Article No.121896, 2022. https://doi.org/10.1016/j.energy.2021.121896

- [24] S. Giglio, B. Kelly, and S. Pruitt, “Systemic Risk and the Macroeconomy: An Empirical Evaluation,” J. of Financial Economics, Vol.119, Issue 3, pp. 457-471, 2016. https://doi.org/10.1016/j.jfineco.2016.01.010

- [25] Q. Ding, J. Huang, and H. Zhang, “Time-Frequency Spillovers among Carbon, Fossil Energy and Clean Energy Markets: The Effects of Attention to Climate Change,” Int. Review of Financial Analysis, Vol.83, Article No.102222, 2022. https://doi.org/10.1016/j.irfa.2022.102222

- [26] Y. Wang and Z. Guo, “The Dynamic Spillover Between Carbon and Energy Markets: New Evidence,” Energy, Vol.149, pp. 24-33, 2018. https://doi.org/10.1016/j.energy.2018.01.145

- [27] R. Wu and Z. Qin, “Assessing the Extreme Risk Spillovers to Carbon Markets from Energy Markets: Evidence from China,” Environmental Science and Pollution Research, Vol.30, No.13, pp. 37894-37911, 2022. https://doi.org/10.1007/s11356-022-24610-4

- [28] C. Diks and V. Panchenko, “A New Statistic and Practical Guidelines for Nonparametric Granger Causality Testing,” J. of Economic Dynamics and Control, Vol.30, Issues 9-10, pp. 1647-1669, 2006. https://doi.org/10.1016/j.jedc.2005.08.008

- [29] T. Bollerslev, “Generalized Autoregressive Conditional Heteroskedasticity,” J. of Econometrics, Vol.31, Issue 3, pp. 307-327, 1986. https://doi.org/10.1016/0304-4076(86)90063-1

- [30] Y. Yao and B. Xu, “Conditional Distribution Prediction of Stock Returns and its Application on Risk Aversion Analysis,” J. Adv. Comput. Intell. Intell. Inform., Vol.22, Issue 4, pp. 448-456, 2018. https://doi.org/10.20965/jaciii.2018.p0448

- [31] C. Hiemstra and J. D. Jones, “Testing for Linear and Nonlinear Granger Causality in the Stock Price-Volume Relation,” J. of Finance, Vol.49, No.5, pp. 1639-1664, 1994. https://doi.org/10.2307/2329266

- [32] C. Sui, X. Wang, and Z. Wang, “Heterogeneity of Interbank Network Connection Tendency and Risk Contagion,” Int. Finance Research, Issue 07, pp. 44-53, 2017. https://doi.org/10.16475/j.cnki.1006-1029.2017.07.005

- [33] G. Fagiolo, “Clustering in Complex Directed Networks,” Physical Review E, Vol.76, Issue 2, Article No.26107, 2007. https://doi.org/10.1103/PhysRevE.76.026107

- [34] F. Zhu, F. Jin, H. Wu, and F. Wen, “The Impact of Oil Price Changes on Stock Returns of New Energy Industry in China: A Firm-Level Analysis,” Physica A: Statistical Mechanics and its Applications, Vol.532, Article No.121878, 2019. https://doi.org/10.1016/j.physa.2019.121878

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.