Research Paper:

Optimization Trading Strategy Model for Gold and Bitcoin Based on Market Fluctuation

Hong-Xia Xie*, Yan Feng**,†, Xue-Yong Yu*, and Yu-Ning Hu*

*School of Computer and Computing Science, Zhejiang University City College

P. O. Box 94, No.51 Huzhou Street, Gongshu District, Hangzhou, Zhejiang 310015, China

**Zhejiang Metals and Materials Co.

78 Fengqi Road, Hangzhou City, Zhejiang 310003, China

†Corresponding author

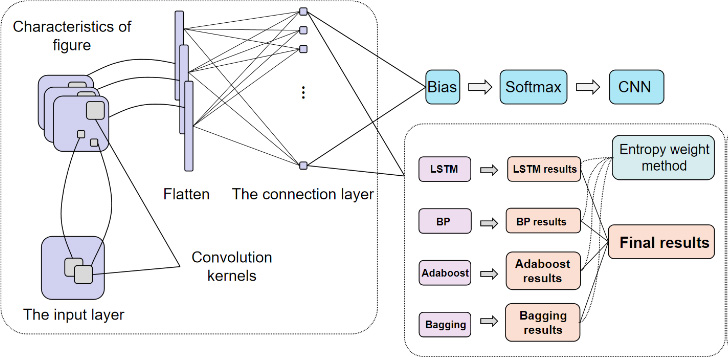

As a new type of digital currency, Bitcoin is considered as “future gold” by various scholars. Therefore, this study considers Bitcoin and gold as a group of hedging assets to conduct investment research and it also discusses the investment rules between Bitcoin and gold: prediction of the rise and fall of Bitcoin, comparison of the characteristics of Bitcoin and gold, and the impact of the transaction procedures of Bitcoin and gold on the final trading results, and formulates trading strategies through optimization algorithms. Then, four machine learning algorithms, i.e., LSTM, BP neural network, Adaboost, and Bagging, are introduced to predict the rise and fall of gold and Bitcoin the next day, and then, the entropy weight method is used to synthesize four predicted results to ensure the robustness of the predicted results. To establish the optimal trading strategy, this study considers the maximum expected return as the goal to develop a single-objective optimization model and historical five-day price volatility as a risk factor. In this study, ant colony, simulated annealing, and genetic algorithms are used to solve the single-objective optimization model. Finally, we conclude that Bitcoin, similar to other financial assets, e.g., gold, is sensitive to shocks and volatile and possesses a relatively quiet cycle. When Bitcoin has an asymmetric impact, Bitcoin and gold can equally treat transactions.

Rise and fall prediction of gold and bitcoin based on LSTM, BP neural network, Adaboost, and Bagging

- [1] Bitcoin like gold: expert opinion, https://0xzx.com/2021022300271202452.html [Accessed February 10, 2021]

- [2] A. H. Dyhrberg, “Hedging capabilities of bitcoin. Is it the virtual gold?,” Finance Research Letters, Vol.16, pp. 139-144, 2016. https://doi.org/10.1016/j.frl.2015.10.025

- [3] C. Conrad, A. Custovic, and E. Ghysels, “Long- and Short-Term Cryptocurrency Volatility Components: A GARCH-MIDAS Analysis,” J. of Risk and Financial Management, Vol.11, No.2, pp. 1-23, 2018. https://doi.org/10.3390/jrfm11020023

- [4] P. Katsiampa, “Volatility estimation for Bitcoin: A comparison of GARCH models,” Economics Letters, Vol.158, pp. 3-6, 2017. https://doi.org/10.1016/j.econlet.2017.06.023

- [5] J. Chu, S. Chan, S. Nadarajah et al., “GARCH Modelling of Cryptocurrencies,” J. of Risk and Financial Management, Vol.10, No.4, Article No.17, 2017. https://doi.org/10.3390/jrfm10040017

- [6] E. Bouri, R. Gupta, A. K. Tiwari et al., “Does Bitcoin hedge global uncertainty? Evidence from wavelet-based quantile-in-quantile regressions,” Finance Research Letters, Vol.23, pp. 87-95, 2017. https://doi.org/10.1016/j.frl.2017.02.009

- [7] T. Klein, H. Pham Thu, and T. Walther, “Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance,” Int. Review of Financial Analysis, Vol.59, pp. 105-116, 2018. https://doi.org/10.1016/j.irfa.2018.07.010

- [8] A. H. Dyhrberg, “Bitcoin, gold and the dollar–A GARCH volatility analysis,” Finance Research Letters, Vol.16, pp. 85-92, 2016. https://doi.org/10.1016/j.frl.2015.10.008

- [9] E. Bouri, P. Molnár, G. Azzi et al., “On the hedge and safe haven properties of Bitcoin: Is it really more than a diversifier?,” Finance Research Letters, Vol.20, pp. 192-198, 2017. https://doi.org/10.1016/j.frl.2016.09.025

- [10] I. Henriques and P. Sadorsky, “Can Bitcoin Replace Gold in an Investment Portfolio?,” J. of Risk and Financial Management, Vol.11, No.3, Article No.48, 2018. https://doi.org/10.3390/jrfm11030048

- [11] H. Shin, H. R. Roth, M. Gao et al., “Deep Convolutional Neural Networks for Computer-Aided Detection: CNN Architectures, Dataset Characteristics and Transfer Learning,” IEEE Trans. on Medical Imaging, Vol.35, No.5, pp. 1285-1298, 2016. https://doi.org/10.1109/TMI.2016.2528162

- [12] H. R. Stoll and R. E. Whaley, “Expiration day effects of the all ordinaries share price index futures: empirical evidence and alternative settlement procedures,” Australian J. of Management, Vol.22, No.2, pp. 139-174, 1997. https://doi.org/10.1177/031289629702200202

- [13] R. Fox, “Directed molecular evolution by machine learning and the influence of nonlinear interactions,” J. of Theoretical Biology, Vol.234, No.2, pp. 187-199, 2005. https://doi.org/10.1016/j.jtbi.2004.11.031

- [14] Z. Tao, G. Haiyan, and C. Zenan, “A Median Filtering Forensics CNN Approach Based on Local Binary Pattern,” Proc. of the 11th Int. Conf. on Computer Engineering and Networks, pp. 258-266, 2022. https://doi.org/10.1007/978-981-16-6554-7_30

- [15] R. P. Silva, B. B. Zarpelão, A. Cano et al., “Time Series Segmentation Based on Stationarity Analysis to Improve New Samples Prediction,” Sensors, Vol.21, No.21, Article No.7333, 2021. https://doi.org/10.3390/s21217333

- [16] W. Lu, J. Li, Y. Li et al., “A CNN-LSTM-Based Model to Forecast Stock Prices,” Complexity, 2020, pp. 1-10, 2020. https://doi.org/10.1155/2020/6622927

- [17] D. Zhang and S. Lou, “The application research of neural network and BP algorithm in stock price pattern classification and prediction,” Future Generation Computer Systems, Vol.115, pp. 872-879, 2021. https://doi.org/10.1016/j.future.2020.10.009

- [18] J. Wang and Y. Chen, “Adaboost-Based Integration Framework Coupled Two-Stage Feature Extraction with Deep Learning for Multivariate Exchange Rate Prediction,” Neural Processing Letters, Vol.53, No.6, pp. 4613-4637, 2021. https://doi.org/10.1007/s11063-021-10616-5

- [19] I. Ghosh, M. K. Sanyal, and R. K. Jana, “An Ensemble of Ensembles Framework for Predictive Analytics of Commodity Market,” Proc. of the IEEE 4th Int. Conf. on Computational Intelligence and Networks (CINE 2020), pp. 1-6, 2020. https://doi.org/10.1109/CINE48825.2020.234398

- [20] E. Bouri, S. J. H. Shahzad, D. Roubaud et al., “Bitcoin, gold, and commodities as safe havens for stocks: New insight through wavelet analysis,” The Quarterly Review of Economics and Finance, Vol.77, pp. 156-164, 2020. https://doi.org/10.1016/j.qref.2020.03.004

- [21] S. J. H. Shahzad, E. Bouri, D. Roubaud et al., “Is Bitcoin a better safe-haven investment than gold and commodities?,” Int. Review of Financial Analysis, Vol.63, pp. 322-330, 2019. https://doi.org/10.1016/j.irfa.2019.01.002

- [22] N. P. Ong and R. N. Bhatt, “More is different: Fifty years of condensed matter physics,” Princeton University Press, 2001. https://doi.org/10.2307/j.ctv16t6n15

- [23] F. Fei, A. Fuertes, and E. Kalotychou, “Dependence in credit default swap and equity markets: Dynamic copula with Markov-switching,” Int. J. of Forecasting, Vol.33, No.3, pp. 662-678, 2017. https://doi.org/10.1016/j.ijforecast.2017.01.006

- [24] S. Hammoudeh and Y. Yuan, “Metal volatility in presence of oil and interest rate shocks,” Energy Economics, Vol.30, No.2, pp. 606-620, 2008. https://doi.org/10.1016/j.eneco.2007.09.004

- [25] F. Capie, T. C. Mills, and G. Wood, “Gold as a hedge against the dollar,” J. of Int. Financial Markets, Institutions and Money, Vol.15, No.4, pp. 343-352, 2005. https://doi.org/10.1016/j.intfin.2004.07.002

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.