Paper:

Impact of Economic Policy Uncertainty on the Distribution of China’s Stock Returns: An External Perspective

Yanyun Yao*, Haijing Yu**, Huimin Wang*, and Tsung-Kuo Tien-Liu***

*Department of Applied Statistics, Shaoxing University

900 Chengnan Avenue, Yuecheng District, Shaoxing, Zhejiang 312000, China

**Research Institute of Economic Statistics and Quantitative Economics, Zhejiang Gongshang University

18 Xuezheng Road, Xiasha University Town, Hangzhou, Zhejiang 310018, China

***Office of Physical Education, Fu Jen Catholic University

8F.-2, No.127 Dazhong South Street, West District, Taichung City 40347, Taiwan

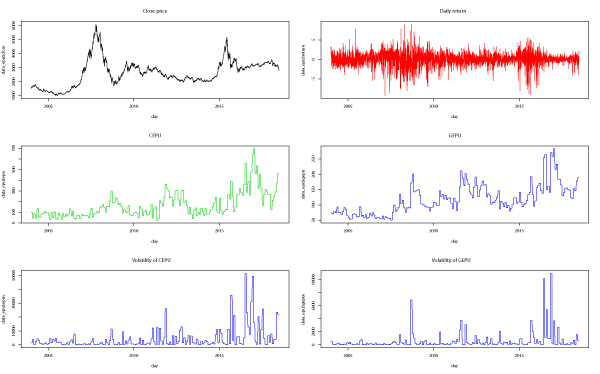

This study examines the impact of external economic policy uncertainty on the distribution of China’s stock returns. The Chinese Economic Policy Uncertainty (CEPU) and global EPU (GEPU) indexes compiled by [1] are employed as a measurement of the external uncertainty. An empirical study is conducted using the GARCH-MIDAS framework. The first innovation of this study is extending the symmetric GARCH-MIDAS model to the case of GJR; the leverage effect is therefore considered. The second innovation is considering the impact of EPU on the overall distribution of returns, rather than on the mean or volatility. Full-sample fitting shows that CEPU can explain around 14% of the return volatility, and CEPU together with GEPU can explain about 17%. Out-of-sample recursive forecasting demonstrates that it is meaningful to extend the models to GJR; the EPU information improves the return distribution forecasting. However, the impact of EPUs is limited, which implies that external uncertainty is quite different from the “internal” economic policy uncertainty directly driving the China’s stock market.

Daily closing price and return, level and volatility of CEPU and GEPU

- [1] S. R. Baker, N. Bloom, and S. J. Davis, “Measuring Economic Policy Uncertainty,” The Quarterly J. of Economics, Vol.131, Issue 4, pp. 1593-1636, 2016.

- [2] Q. Wang, “The Analysis and Comparative Study of Stock Market Extreme Ups and Downs – Based on Stock Markets of China, US, UK and Japan,” Financial & Science, No.8, pp. 17-25, 2011 (in Chinese).

- [3] G. Chen, R. Zhang, and X. Zhao, “Policy Uncertainty, Consumption Behavior and Asset Pricing,” The J. of World Economy, Vol.40, No.1, pp. 116-141, 2017 (in Chinese).

- [4] G. Chen, R. Zhang, and X. Zhao, “Economic Policy Uncertainty and Stock Risk Characteristics,” J. of Management Sciences in China, Vol.21, No.4, pp. 1-27, 2018 (in Chinese).

- [5] W. You, Y. Guo, H. Zhu, and T. Tang, “Oil Price Shocks, Economic Policy Uncertainty and Industry Stock Returns in China: Asymmetric Effects with Quantile Regression,” Energy Economics, Vol.68, pp. 1-18, 2017.

- [6] X.-M. Li, “New evidence on economic policy uncertainty and equity premium,” Pacific-Basin Finance J., Vol.46, Part A, pp. 41-56, 2017.

- [7] H. Asgharian, C. Christiansen, and A. J. Hou, “Effects of macroeconomic uncertainty on the stock and bond markets,” Finance Research Letters, Vol.13, pp. 10-16, 2015.

- [8] C. Conrad and K. Loch, “The variance risk premium and fundamental uncertainty,” Economics Letters, Vol.132, pp. 56-60, 2015.

- [9] A. Ferguson and P. Lam, “Government policy uncertainty and stock prices: The case of Australia’s uranium industry,” Energy Economics, Vol.60, pp. 97-111, 2016.

- [10] L. Fang, Y. Qian, Y. Chen, and H. Yu, “How does stock market volatility react to NVIX? Evidence from developed countries,” Physica A: Statistical Mechanics and Its Application, Vol.505, pp. 490-499, 2018.

- [11] G. Bekaert and M. Hoerova, “The VIX, the variance premium and stock market volatility,” J. of Econometrics, Vol.183, Issue 2, pp. 181-192, 2014.

- [12] T. G. Bali, S. J. Brown, and Y. Tang, “Macroeconomic Uncertainty and Expected Stock Returns,” Georgetown McDonough School of Business Research Paper, No.2407279, 2014, https://www.aeaweb.org/conference/2015/retrieve.php?pdfid=467 [accessed October 23, 2018]

- [13] J. Strobel, “On the different approaches of measuring uncertainty shocks,” Economics Letters, Vol.134, pp. 69-72, 2015.

- [14] K. Jurado, S. C. Ludvigson, and S. Ng, “Measuring Uncertainty,” American Economic Review, Vol.105, No.3, pp. 1177-1216, 2015.

- [15] A. Manela and A. Moreira, “News implied volatility and disaster concerns,” J. of Financial Economics, Vol.123, Issue 1, pp. 137-162, 2017.

- [16] J. Brogaard and A. Detzel, “The Asset Pricing Implications of Government Economic Policy Uncertainty,” Management Science, Vol.61, No.1, pp. 3-18, 2015.

- [17] M. Arouri, C. Estay, C. Rault, and D. Roubaud, “Economic policy uncertainty and stock markets: Long-run evidence from the US,” Finance Research Letter, Vol.18, pp. 136-141, 2016.

- [18] L. Lei, J. Yu, Y. Wei, and X. Lai, “Forecasting Volatility of Chinese Stock Market with Economic Policy Uncertainty,” J. of Management Science in China, Vol.21, No.6, pp. 88-98, 2018 (in Chinese).

- [19] R. F. Engle, E. Ghysels, and B. Sohn, “Stock Market Volatility and Macroeconomic Fundamentals,” Review of Economics and Statistics, Vol.95, Issue 3, pp. 776-797, 2013.

- [20] E. Girardin and R. Joyeux, “Macro fundamentals as a source of stock market volatility in China: A GARCH-MIDAS approach,” Economic Modelling, Vol.34, pp. 59-68, 2013.

- [21] T. Zheng and Y. Shang, “Stock Market Volatility Measurement and Forecast based on Macro Fundamentals,” The J. of World Economy, Vol.37, No.12, pp. 118-139, 2014 (in Chinese).

- [22] D. Zhou, Q. Jia, and Z. Li, “Study on the Long and Short Component Measure of Stock Market Volatility Based on the Uncertainty of China’s Monetary Policy,” J. of Financial Development Research, No.5, pp. 25-32, 2017 (in Chinese).

- [23] L. R. Glosten, R. Jagannathan, and E. Runkle, “On the Relation between the Expected Value and the Volatility of the Norminal Excess Return on Stocks,” The J. of Finance, Vol.48, Issue 5, pp. 1779-1801, 1993.

- [24] D. Pettenuzzo, A. Timmermann, and R. Valkanov, “A MIDAS approach to modeling first and second moment dynamics,” J. of Econometrics, Vol.193, Issue 2, pp. 315-334, 2016.

- [25] K. Shi, “The Research on the Stock Market Volatility in China Based on Mixed Frequency Data,” Master thesis, Nanjing University of Finance & Economics, 2014 (in Chinese).

- [26] C. Conrad and O. Kleen, “Two are better than one: volatility forecasting using multiplicative component GARCH models,” SSRN, doi:10.2139/ssrn.2752354, 2018.

- [27] F. X. Diebold, T. A. Gunther, and A. S. Tay, “Evaluating Density Forecasts with Applications to Financial Risk Management,” Int. Economic Review, Vol.39, No.4, pp. 863-883, 1998.

- [28] T. Gneiting, F. Balabdaoui, and A. E. Raftery, “Probabilistic forecasts, calibration and sharpness,” J. of the Royal Statistical Society, Statistical Methodology Series B, Vol.69, Issue 2, pp. 243-268, 2007.

- [29] Y. Hong and H. Li, “Nonparametric Specification Testing for Continuous-Time Models with Applications to Term Structure of Interest Rates,” The Review of Financial Studies, Vol.18, Issue 1, pp. 37-84, 2005.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.