Research Paper:

Digital Inclusive Finance and Industrial Structure Upgrade —Based on Nonlinear Relationship Perspective

Shuping Lin*,** and Wenhui Ma*,**,†

*Ningbo University of Finance & Economics

No.899 Xueyuan Road, Haishu District, Ningbo City, Zhejiang 315175, China

**Ningbo Key Research Base for Philosophy and Social Studies “Regional Open Cooperation and Free Trade Zone Research Base”

No.899 Xueyuan Road, Haishu District, Ningbo City, Zhejiang 315175, China

†Corresponding author

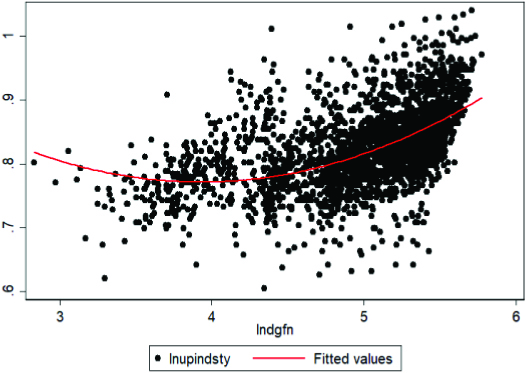

Compared with traditional finance, digital inclusive finance involves particular policies, different targeting, and wider coverage, plays a positive role in promoting the development of the real economy, and upgrades to industrial facilities. Based on the panel data of 288 prefecture-level cities in China from 2011 to 2019, in this study, we empirically examined the impact of digital inclusive finance on upgrades to industrial structures. The experimental results showed a “U”-shaped nonlinear relationship between the development of digital inclusive finance and the upgrades to industrial structure. In particular, this conclusion remained valid after citing instrumental variables, replacing core explanatory variables, and performing other robustness tests. Furthermore, we used the threshold model to test the influence of digital inclusive finance on industrial structure upgrade, and observed a double threshold effect based on digital inclusive finance and local levels of economic development. Therefore, in the dynamic transformation towards digital inclusive finance and continuing economic development, the role of digital inclusive finance in promoting industrial structure upgrade continues to strengthen.

Nonlinear relationship between ISU and DIF

- [1] H. Zheng, Z. Lin, and X. Rui, “Industrial Upgrading, Financial Structure, and China’s Economic Growth,” J. of Management World, Vol.37, No.8, pp. 58-88, 2021 (in Chinese). https://doi.org/10.19744/j.cnki.11-1235/f.2021.0107

- [2] H. Yang and Q. Wang, “Research on the Impact and Mechanism of Digital Financial Inclusion on Industrial Structure Upgrading,” Review of Investment Studies, Vol.40, No.9, pp. 4-14, 2021 (in Chinese).

- [3] R. Levine, “Financial Development and Economic Growth: Views and Agenda,” J. of Economic Literature, Vol.35, No.2, pp. 688-726, 1997.

- [4] Q. Li, “Financial Development and China’s Industrial Upgrading in Perspective of Global Value Chain,” J. of Business Economics, Vol.2015, No.6, pp. 86-96, 2015 (in Chinese). https://doi.org/10.14134/j.cnki.cn33-1336/f.2015.06.009

- [5] D.-G. Bei and R. Zhang, “Financial Inclusion Strategies in the Context of Inclusive Growth,” Economic Theory and Business Management, Vol.2017, No.2, pp. 5-12, 2017 (in Chinese).

- [6] T. Ren and Z. Yin, “Digital Financial Inclusion and Inclusive Growth of Chinese Economy: Theoretical Analysis and Empirical Evidence,” J. of Management, Vol.35, No.1, pp. 23-35, 2022 (in Chinese). https://doi.org/10.19808/j.cnki.41-1408/f.2022.0003

- [7] S. Tang, X. Wu, and J. Zhu, “Digital Finance and Enterprise Technology Innovation: Structural Feature, Mechanism Identification and Effect Difference Under Financial Supervision,” J. of Management World, Vol.36, No.5, pp. 52-66+9, 2020 (in Chinese). https://doi.org/10.19744/j.cnki.11-1235/f.2020.0069

- [8] K. Zhong et al., “Digital Financial Inclusion and Secondary Allocation of Commercial Credit,” China Industrial Economics, Vol.2022, No.1, pp. 170-188, 2022 (in Chinese). https://doi.org/10.19581/j.cnki.ciejournal.2022.01.008

- [9] R. Shi, “Digital Inclusive Finance, Family Education Investment and Human Capital Accumulation,” Master thesis, Zhejiang University, 2022 (in Chinese).

- [10] F. Guo et al., “Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics,” China Economic Quarterly, Vol.19, No.4, pp. 1401-1418, 2020 (in Chinese). 10.13821/j.cnki.ceq.2020.03.12

- [11] Z. Xu, Y.-Y. Zhang, and Y. Gao, “Digital Finance Development and Manufacturing Industry Upgrading – Effect Identification and China’s Experience,” J. of Shanxi University of Finance and Economics, Vol.44, No.10, pp. 73-84, 2022 (in Chinese). https://doi.org/10.13781/j.cnki.1007-9556.2022.10.006

- [12] J. Zhao, Y. Li, and W. Zhu, “Digital Finance, Green Innovation and High Quality Urban Development,” South China Finance, Vol.2021, No.10, pp. 22-36, 2021 (in Chinese).

- [13] Z. Huang and Y. Wang, “Big Data, Internet Finance and Credit Capital: Resolving Small and Micro Businesses’ Financing Paradox,” J. of Finance and Economics, Vol.30, No.1, pp. 55-67, 2015 (in Chinese).

- [14] P. Gomber et al., “On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services,” J. of Management Information Systems, Vol.35, No.1, pp. 220-265, 2018. https://doi.org/10.1080/07421222.2018.1440766

- [15] W. Zou and J. Ling, “Inclusive Finance and the Financing Constraints of SMEs – Evidence from SMEs in China,” Collected Essays on Finance and Economics, Vol.2018, No.6, pp. 34-45, 2018 (in Chinese). https://doi.org/10.13762/j.cnki.cjlc.2018.06.003

- [16] Y. Niu, “An Empirical Research on the Impact of Digital Inclusive Financial Development on Poverty Alleviation in China,” Master thesis, Shandong University, 2018 (in Chinese).

- [17] Q.-X. Bai and K. Zhang, “Redefinition and Characteristics of Inclusive Finance,” J. of Guangdong University of Finance & Economics, Vol.32, No.3, pp. 39-44, 2017 (in Chinese).

- [18] L. Zhang, “Digital Inclusive Finance, County Industrial Upgrading with Farmers’ Income Growth,” Research on Financial and Economic Issues, Vol.2021, No.6, pp. 51-59, 2021 (in Chinese). https://doi.org/10.19654/j.cnki.cjwtyj.2021.06.005

- [19] R. Tan and Q. Lu, “Does Digital Financial Inclusion Promote the Optimization and Upgrading of Industrial Structure?,” Review of Investment Studies, Vol.40, No.9, pp. 85-104, 2021 (in Chinese).

- [20] W.-J. Tang, S. Li, and Y.-Q. Tao, “The Development of Digital Inclusive Finance and Industrial Structure Upgrading: Empirical Evidence from 283 Cities,” J. of Guangdong University of Finance & Economics, Vol.34, No.6, pp. 35-49, 2019 (in Chinese).

- [21] D. Wang, L. Li, and G. Ran, “Financial Capital Formation and Economic Growth,” Economic Research J., Vol.44, No.9, pp. 39-51+105, 2009 (in Chinese).

- [22] C. Zhang and B. Zhang, “The Falling Real Investment Puzzle: A View from Financialization,” Economic Research J., Vol.51, No.12, pp. 32-46, 2016 (in Chinese).

- [23] N. Hermes and R. Lensink, “Microfinance: Its Impact, Outreach, and Sustainability,” World Development, Vol.39, No.6, pp. 875-881, 2011. https://doi.org/10.1016/j.worlddev.2009.10.021

- [24] Y. Xing, “The Effectiveness and Realization of Inclusive Finance: Review and Enlightenment,” Studies of Int. Finance, Vol.2015, No.11, pp. 24-36, 2015 (in Chinese). https://doi.org/10.16475/j.cnki.1006-1029.2015.11.003

- [25] B. E. Hansen, “Threshold effects in non-dynamic panels: Estimation, testing, and inference,” J. of Econometrics, Vol.93, No.2, pp. 345-368, 1999. https://doi.org/10.1016/S0304-4076(99)00025-1

- [26] Z.-Z. Chang, C.-J. Chen, and J. Zhang, “Research on the Applicability of Innovation-Driven Development Strategy from the Perspective of Industrial Structure Upgrading – An Empirical Analysis Based on Panel Data of China’s Four Major Economic Zones,” Economist, Vol.2019, No.8, pp. 62-74, 2019 (in Chinese). https://doi.org/10.16158/j.cnki.51-1312/f.2019.08.006

- [27] D. Xu, “A Theoretical Explanation and Verification of the Determination and Measurement of Industrial Structure Upgrading,” Public Finance Research, Vol.2008, No.1, pp. 46-49, 2008 (in Chinese). https://doi.org/10.19477/j.cnki.11-1077/f.2008.01.015

- [28] Y.-Y. Zhang and S.-C. Hu, “Research on the Impact of Digital Inclusive Finance on the Coordinated Development of Economy and Environment – Mediating Effect of Innovation-Driven,” Soft Science (in press) (in Chinese).

- [29] J. Liu et al., “Digital Inclusive Finance, Enterprise Life Cycle and Technological Innovation,” Statistics & Decision, Vol.38, No.19, pp. 130-134, 2022 (in Chinese). https://doi.org/10.13546/j.cnki.tjyjc.2022.19.026

- [30] Y. Li and Y. Shen, “Digital Financial Inclusion and Regional Economic Imbalance,” China Economic Quarterly, Vol.22, No.5, pp. 1805-1828, 2022 (in Chinese). https://doi.org/10.13821/j.cnki.ceq.2022.05.17

- [31] X. Li and G. Ran, “Digital Financial Development, Capital Allocation Efficiency and Industrial Structure Upgrading,” J. of Southwest Minzu University (Humanities and Social Sciences), Vol.42, No.7, pp. 152-162, 2021 (in Chinese).

- [32] B. Lin and J. Chen, “Upgrading Effect and Spatial Difference of Industrial Structure of Digital Inclusive Finance,” Fujian Tribune, Vol.2022, No.5, pp. 76-86, 2022 (in Chinese).

- [33] Y. Zhou, W. Wang, and X. Liu, “Cognitive Ability and Financial Exclusion of Chinese Households: An Empirical Study Based on CFPS Data,” Economic Science, Vol.2018, No.1, pp. 96-112, 2018 (in Chinese).

- [34] M. Pei and D. Fang, “Industrial Structure Upgrading, Regional Innovation and Economic Growth – A GMM Analysis Based on Provincial Panel Data,” J. of Jilin Business and Technology College, Vol.35, No.5, pp. 21-25, 2019 (in Chinese). https://doi.org/10.19520/j.cnki.issn1674-3288.2019.05.003

- [35] H.-K. Cui and X. Wei, “Private Investment, Industrial Structure and Economic Growth: Empirical Analysis Based on China’s Provincial Dynamic Panel Data,” On Economic Problems, Vol.2018, No.1, pp. 15-19, 2018 (in Chinese). https://doi.org/10.16011/j.cnki.jjwt.2018.01.003

- [36] X. Yi and L. Zhou, “Does Digital Financial Inclusion Significantly Influence Household Consumption? Evidence from Household Survey Data in China,” J. of Financial Research, Vol.2018, No.11, pp. 47-67, 2018 (in Chinese).

- [37] X. Li and F. Deng, “Technological Innovation, Industrial Structure Upgrading and Economic Growth,” Science Research Management, Vol.40, No.3, pp. 84-93, 2019 (in Chinese). https://doi.org/10.19571/j.cnki.1000-2995.2019.03.009

- [38] T. Guo and X. Ding, “An International Comparative Study of Inclusive Finance – From the Perspective of Banking Services,” Studies of Int. Finance, Vol.2015, No.2, pp. 55-64, 2015 (in Chinese). https://doi.org/10.16475/j.cnki.1006-1029.2015.02.006

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.