Paper:

Hedonic Price Ripple Effect and Consumer Choice: Evidence from New Homes

Guangtong Gu

School of Economics and Management, Zhejiang A & F University

Center for China Farmers’ Development of Zhejiang

No.252 Yijing Street, Lin’an City, Hangzhou, Zhejiang 311300, China

Research Institute of Quantitative Economics, Zhejiang Gongshang University

Hangzhou, Zhejiang 310018, China

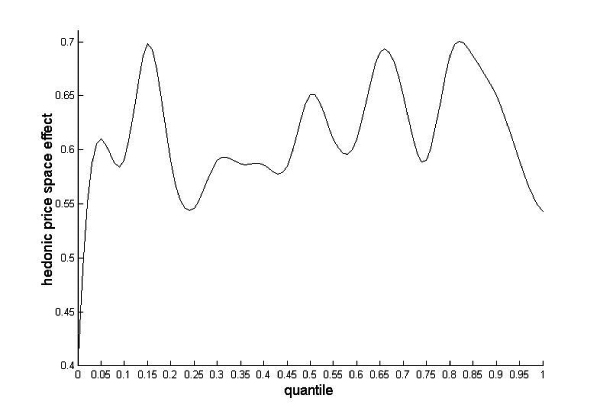

This study uses the hedonic price model to examine the determinants of house prices. It employs kernel density to estimate the spatial weight matrix and conducts spatial econometrics and instrumental variables quantile regression analysis. Taking a new building in Shanghai city as an example, this micro-perspective study shows that hedonic prices of houses are derived from consumer hedonic preferences and their changes in terms of inertia and spatial ripple effects. However, there are large differences in the drivers of the same hedonic attribute across quantile degrees. With house prices gradually decreasing from the city center to the surrounding areas, the ripple effect is significant in determining residents’ preferred consumption characteristics and presents several inverted U-shaped and inverted U-shaped relationships. Residents’ preference for housing consumption is mainly reflected in the average area of the house, property fee, location of the administrative area, and so on. Regional real estate price changes are mainly reflected in hedonic house prices, and real consumer demand for housing is mainly derived from hedonic preference. Therefore, government regulation and control of house prices should consider different regions and different consumer groups simultaneously.

Spatial spread effect of house hedonic price at different points

- [1] K. J. Lancaster, “A new approach to consumer theory,” J. of Political Economy, Vol.74, No.2, pp. 132-157, 1966.

- [2] S. Rosen, “Hedonic prices and implicit markets: product differentiation in pure competition,” J. of Political Economy, Vol.82, No.1, pp. 34-55, 1974.

- [3] K. W. Chau, C. Y. E. Yiu, S. K. Wong, and L. W. C. Lai, “Hedonic price modelling of environmental attributes: a review of the literature and a Hong Kong case study,” Understanding And Implementing Sustainable Development, pp. 87-110, 2003.

- [4] W. R. Tobler, “A Computer Movie Simulating Urban Growth in the Detroit Region,” Economic Geography, Vol.46, Supplement 1, pp. 234-240, 1970.

- [5] L. Anselin, “Spatial Econometrics: Methods and Models,” Springer, 1988.

- [6] M. F. Goodchild, “The Validity and Usefulness of Laws in Geographic Information Science and Geography,” Annals of the Association of American Geographers, Vol.94, No.2, pp. 300-303, 2004.

- [7] L. Yao, G. F. Gu, and J. K. Wang, ”The Spatial Effect of Building New Housing in Zhengzhou City – Based on the Spatial Econometrics Model,” Economic Geography, Vol.34, No.1, pp. 69-74, 2014.

- [8] J. P. Elhorst, “Applied Spatial Econometrics: Raising the Bar,” Spatial Economic Analysis, Vol.5, No.1, pp. 9-28, 2010.

- [9] A. Hu and J. Sun, “patial Econometrics: model method and trend,” World Economic Papers, No.6, pp. 111-120, 2014.

- [10] J. L. Sun and P. Yao, “Research Paradigms and Latest developments of Spatial Econometrics,” Economist, No.7, pp. 27-35, 2014.

- [11] R. K. Pace, J. P. Lesage, A. Páez, and S. Dall’erba, “Omitted variable biases of OLS and spatial lag models,” Progress in Spatial Analysis, pp. 17-28, Springer, 2010.

- [12] R. A. Dubin, “Spatial autocorrelation and neighborhood quality,” Regional Science and Urban Economics, Vol.22, No.3, pp. 433-452, 1992.

- [13] R. A. Dubin, “Spatial autocorrelation: a primer,” J. of Housing Economics, Vol.7, No.4, pp. 304-327, 1998.

- [14] H. G. Fereidouni, U. Al-Mulali, J. Y. M. Lee, and A. H. Mohammed, “Dynamic Relationship between House Prices in Malaysia’s Major Economic Regions and Singapore House Prices,” Regional Studies, Vol.50, No.4, pp. 657-670, 2016.

- [15] A. L. Teye, M. Knoppel, J. de Haan, and M. G. Elsinga, “Amsterdam house price ripple effects in The Netherlands,” J. of European Real Estate Research, Vol.10, No.3, pp. 331-345, 2017.

- [16] I. Ekeland, J. J. Heckman, and L. Nesheim, “Identification and Estimation of Hedonic Models,” J. of Political Economy, Vol.112, No.1, pp. 60-109, 2004.

- [17] R. Koenker and G. Bassett Jr., “Regression Quantiles,” Econometrica, Vol.46, No.1, pp. 33-50, 1978.

- [18] J. Zietz, E. N. Zietz, and G. S. Sirmans, “Determinants of house prices: a quantile regression approach,” J. of Real Estate Finance and Economics, Vol.37, No.4, pp. 317-333, 2008.

- [19] S. Mak, L. Choy, and W. Ho, “Quantile Regression Estimates of Hong Kong Real Estate Prices,” Urban Studies, Vol.47, No.11, pp. 2461-2472, 2010.

- [20] H. G. Kim, K. C. Hung, and S. Y. Park, “Determinants of Housing Prices in Hong Kong: A Box-Cox Quantile Regression Approach,” J. of Real Estate Finance and Economics, Vol.50, No.2, pp. 270-287, 2015.

- [21] Y. Luo, “Analysis of factors affecting house prices: Quantile regression methods,” Statistics and Decision, No.6, pp. 158-159, 2011.

- [22] R. J. Hill, “Hedonic price indexes for residential housing: A survey, evaluation and taxonomy,” J. of Economic Surveys, Vol.27, No.5, pp. 879-914, 2012.

- [23] X. Liu, “Spatial and temporal dependence in house price prediction,” J. of Real Estate Finance and Economics, Vol.47, No.2, pp. 341-369, 2013.

- [24] B. Hoen, J. P. Brown, T. Jackson, et al., “Spatial Hedonic Analysis of the Effects of US Wind Energy Facilities on Surrounding Property Values,” J. of Real Estate Finance and Economics, Vol.51, No.1, pp. 22-51, 2015.

- [25] Y. Li, “Demand driven and ripple effects of rising house prices. Also on the Countermeasures of housing prices in China,” Economics: Quarterly, Vol.13, No.1, pp. 443-464, 2014.

- [26] D. Mcmillen, “Perspective on Spatial Econometrics: Linear Smoothing with Structured Model,” J. of Regional Science, Vol.52, No.2, pp. 192-209, 2012.

- [27] V. Chernozhukov and C. Hansen, “Instrumental quantile regression inference for structural and treatment effect models,” J. of Econometrics, Vol.132, No.2, pp. 491-525, 2006.

- [28] V. Chernozhukov and C. Hansen, “Instrumental variable quantile regression: A robust inference approach,” J. of Econometrics, Vol.142, No.1, pp. 379-398, 2008.

- [29] S. Malpezzi, “Hedonic Pricing Models: A Selective and Applied Review,” Wisconsin-Madison CULER Working Papers, No.10, pp. 67-89, 2003.

- [30] S. G. Sirmans, D. A. Macpherson, and E. N. Zietz, “The composition of hedonic pricing models” J. of Real Estate Literature, Vol.13, No.1, pp. 3-43, 2005.

- [31] L. Anselin, “Local indicators of spatial association – ISA,” Geographical Analysis, Vol.27, No.2, pp. 93-115, 1995.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.