Research Paper:

Empirical Analysis of Ticket-Sales Strategies in the Live Entertainment Market

Katsuki Motodaka†

and Takashi Hasuike

and Takashi Hasuike

Department of Industrial and Management Systems Engineering, Waseda University

3-4-1 Okubo, Shinjuku-ku, Tokyo 169-8555, Japan

†Corresponding author

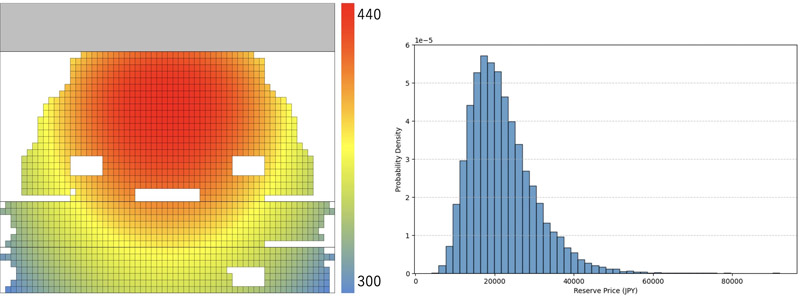

This paper proposes a concrete ticket-sales strategy in the live entertainment market by verifying the effectiveness of hybrid sales, which combine auction sales and uniform pricing methods, based on actual performances held in Japan. To conduct the social simulation of hybrid ticket-sales, we calculated the seat utility values of a particular theater and estimated the reserve price distribution of customers using transaction price data from ticket resale platforms. The results showed that while customer utility and revenue increased when auction sales seats were added, the introduction of more than a certain number of auction sales seats beyond the acceptable level of auction sales decreased customer utility. Furthermore, by allocating additional revenue from auction sales to adjust the uniform ticket price appropriately, we observed that setting approximately 40% of the total seats (700 seats) for auction is optimal for maximizing customer utility. This sales method ensures accessibility for a wide range of customers by providing premium seating to high-paying customers while maintaining affordable pricing for uniform pricing sales. Additionally, it was observed to be an effective sales system that can control illicit profits in the resale market and redistribute the profits from high resale prices to consumers and organizers.

Distributions of seat utility values and reserve prices

- [1] PIA Research Institute, “Live entertainment market survey results and latest future forecasts,” 2024 (in Japanese).

- [2] Lyceum Theatre, “Lyceum theatre London seat map and prices for the Lion King,” 2025.

- [3] K. Hosokawa, “The unique Japanese ‘nominal-S seats’ should not be tolerated: Why a consumer law expert is outraged by the bad practices in the entertainment industry,” PRESIDENT Online, 2023 (in Japanese).

- [4] Consumer Affairs Agency, “Administrative order based on the act against unjustifiable premiums and misleading representations against three concert providers,” 2022 (in Japanese).

- [5] S. Sota, “How can we seek a better solution for the problem of the high-price ticket-resale?,” J. of Atomi University Faculty of Management, Vol.25, pp. 27-40, 2018 (in Japanese).

- [6] A. Bhave and E. Budish, “Primary-market auctions for event tickets: eliminating the rents of “bob the broker”?,” American Economic J., Microeconomics, Vol.15, No.1, pp. 142-170, 2023. https://doi.org/10.1257/mic.20180230

- [7] K. Motodaka and T. Hasuike, “Comparative analysis of ticket sales methods in the live entertainment market,” unpublished (in Japanese).

- [8] S. Takahashi, Y. Goto, and K. Ohori, “Modeling social systems,” Kyoritsu Publishing, 2022 (in Japanese).

- [9] K. Kogai and K. Tanaka, “An optimization model for designing a theater stage focusing on the distance and the angle of the sight line from the audience to the performers,” J. of the City Planning Institute of Japan, Vol.53, No.3, pp. 1448-1455, 2018 (in Japanese). https://doi.org/10.11361/journalcpij.53.1448

- [10] Umeda Arts Theater, “Umeda arts theater main hall seating chart,” 2024 (in Japanese).

- [11] Y. Watanabe, “Estimates of valuation distributions in internet auctions through structural empirical analysis,” Akamon Management Review, Vol.7, No.1, pp. 1-16, 2008 (in Japanese).

- [12] H. Paarsch, “Deriving an estimate of the optimal reserve price: an application to British Columbian timber sales,” J. of Econometrics, Vol.78, No.1, pp. 333-357, 1997. https://doi.org/10.1016/S0304-4076(97)80016-4

- [13] S. Rosen, “Hedonic prices and implicit markets: Product differentiation in pure competition,” J. of Political Economy, Vol.82, No.1, pp. 34-55, 1974. https://doi.org/10.1086/260169

- [14] K. Fukutani, S. Nishino, and K. Ueda, “A study on pricing systems in theatrical industry using multi-agent simulation,” Japan Society for Software and Technology, Vol.25, No.4, pp. 181-189, 2008 (in Japanese). https://doi.org/10.11309/jssst.25.4_181

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.

This article is published under a Creative Commons Attribution-NoDerivatives 4.0 Internationa License.